Market Outlook

July 04, 2018

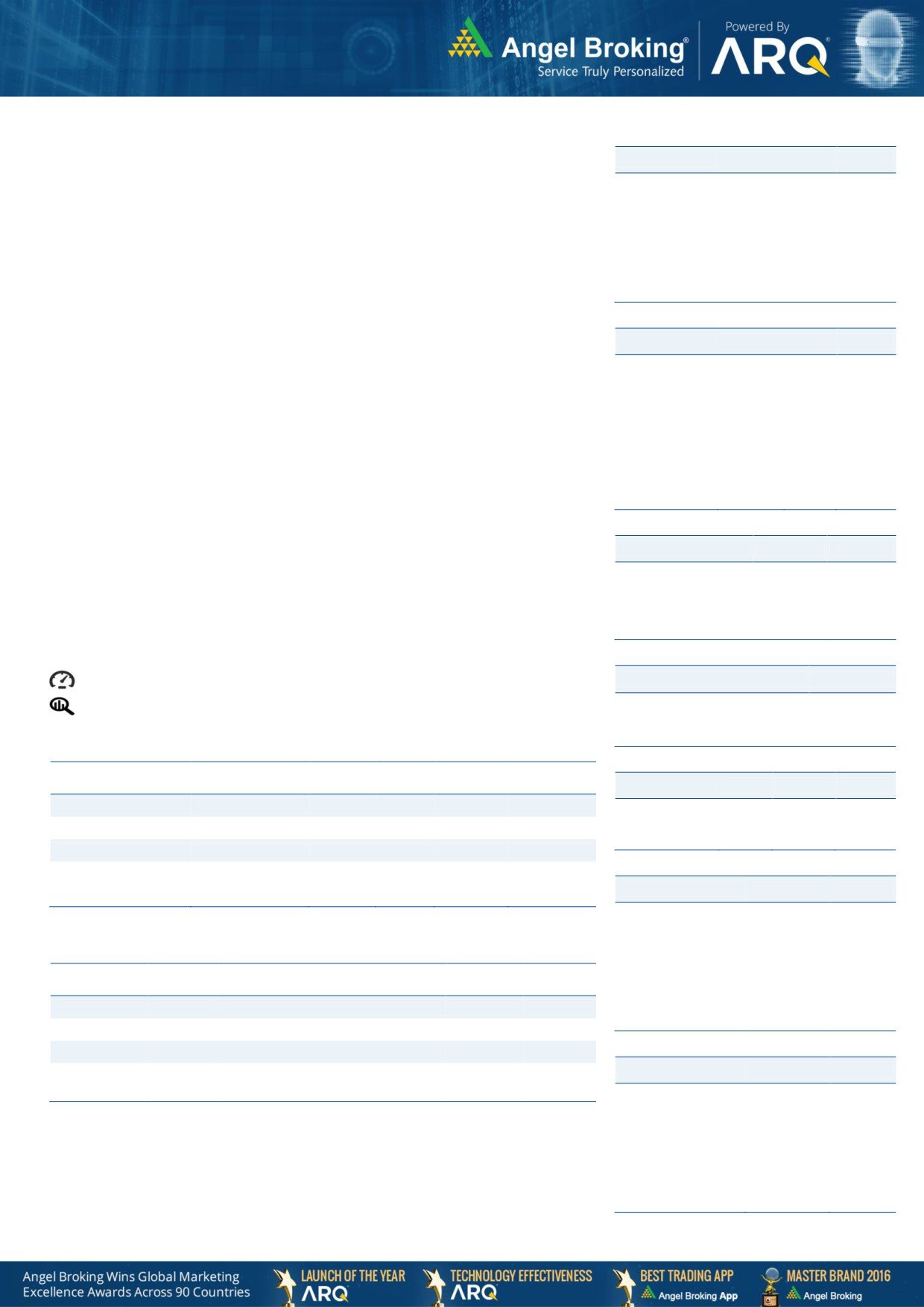

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open negative tracking global indices and SGX Nifty.

BSE Sensex

0.4

114

35,378

U.S. Stocks came under pressure over the course of the abbreviated trading session

Nifty

0.4

42

10,699

on Tuesday. The major averages pulled back off their highs of the session and into

Mid Cap

0.7

105

15,441

negative territory. The pullback by stocks came amid lingering trade concerns as

Small Cap

0.4

70

15,990

tariffs on billions of dollars worth of U.S. and Chinese goods are set to take effect

later this week The Dow Jones was down by 0.5% to 24,174 and the Nasdaq fell by

Bankex

(0.2)

(55)

29,124

0.9% to 7,503.

Global Indices

Chg (%)

(Pts)

(Close)

U.K. stocks were modestly higher yesterday even as caution prevailed ahead of the

July 6 deadline for the Trump Administration's planned imposition of tariffs on

Dow Jones

(0.5)

132

24,174

Chinese imports. The benchmark FTSE 100 was up by 0.6% to 7,593.

Nasdaq

(0.9)

(65)

7,503

FTSE

0.6

45

7,593

On domestic front, Indian shares could end higher on Tuesday with the help of

Gains in pharma and auto stocks, although rising oil prices and caution ahead of

Nikkei

(0.0)

(6)

21,806

the July 6 deadline for the Trump Administration's planned imposition of tariffs on

Hang Seng

(2.8)

(824)

28,131

Chinese imports helped limit the upside. The BSE Sensex was up by 0.4% to 35,378.

Shanghai Com

(0.6)

(16)

2,759

News Analysis

Advances / Declines

BSE

NSE

Supreme Court upholds RBI’s ban on virtual currencies

Advances

1,831

609

Detailed analysis on Pg2

Declines

768

1,196

Unchanged

146

76

Investor’s Ready Reckoner

Key Domestic & Global Indicators

Volumes (` Cr)

Stock Watch: Latest investment recommendations on 150+ stocks

BSE

2,534

r Pg5 onwards

NSE

28,641

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Buy

636

867

35.7

FII

1,738

(2,577)

(4,840)

Dewan Housing Finance

Financials

Buy

624

720

15.4

*MFs

(69)

6,555

65,926

Parag Milk Foods

Others

Buy

309

410

33.8

Bata India

Others

Accumulate

835

948

13.4

Top Gainers

Price (`)

Chg (%)

KEI Industries

Capital Goods

Buy

410

589

43.6

More Top Picks on Pg4

128

8.9

568

7.2

Key Upcoming Events

Previous

Consensus

142

6.8

Date

Region

Event Description

ReadingExpectations

280

6.3

Jul 04, 2018

UK

PMI Manufacturing

54.40

54.00

116

5.9

Jul 05, 2018

Germany PMI Services

53.90

53.90

Jul 06, 2018

US

Change in Nonfarm payrolls

223.00

200.00

Top Losers

Price (`)

Chg (%)

Jul 06, 2018

US

Unnemployment rate

3.80

3.80

Jul 10, 2018

UK

Industrial Production (YoY)

1.80

52

-6.2

More Events on Pg7

483

-5.1

60

-4.9

21

-4.8

407

-3.9

As on July 03, 2018

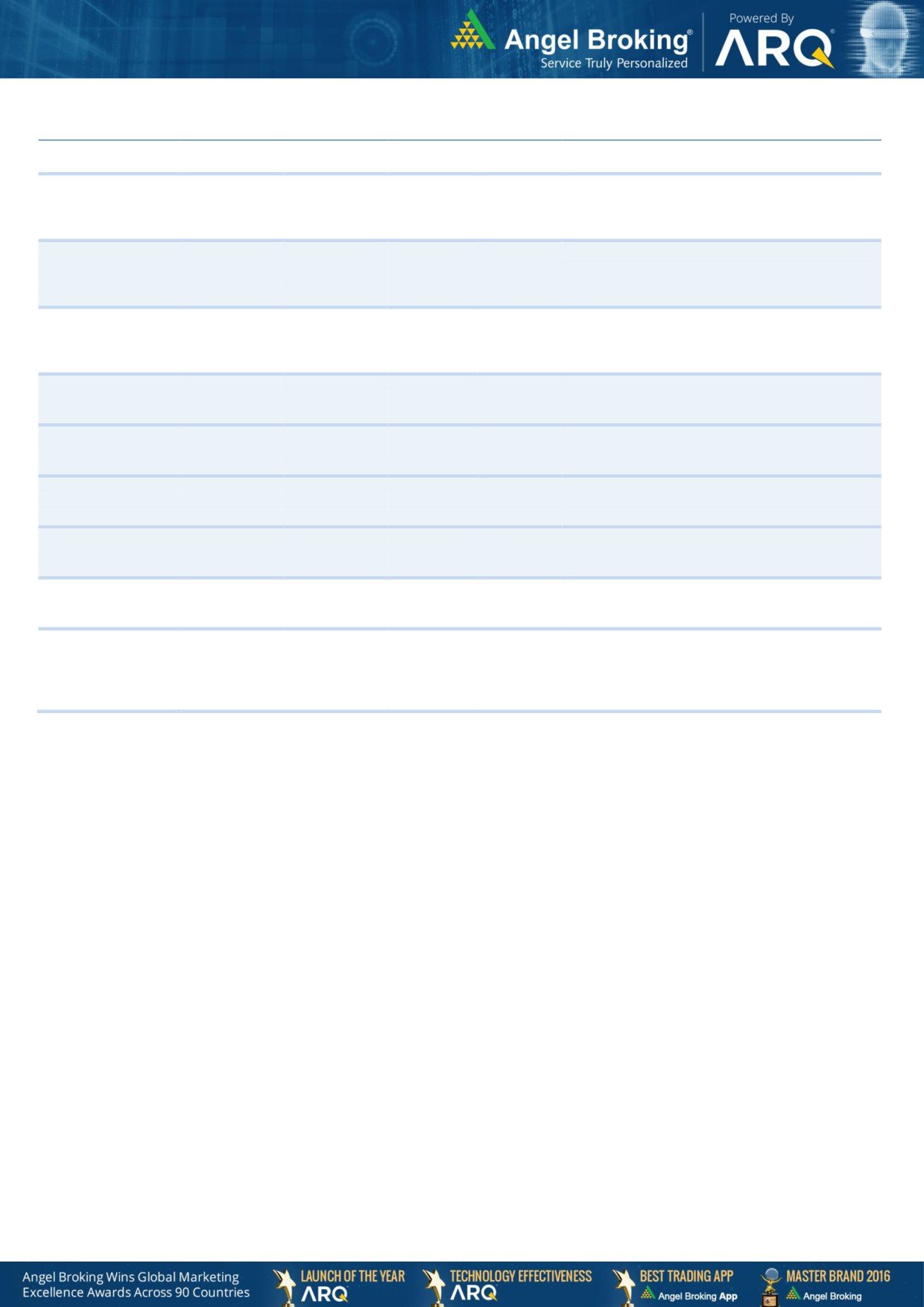

Market Outlook

July 04, 2018

News Analysis

Supreme Court upholds RBI’s ban on virtual currencies

The Supreme Court on Tuesday refused to stay a Reserve Bank of India (RBI)

circular prohibiting banks and financial institutions from dealing in virtual

currencies such as Bitcoin.

With no interim stay on the circular, all virtual currency transactions through

banks would be blocked from 6 July, effectively resulting in a ban.

A bench comprising chief justice Dipak Misra and Justices A.M. Khanwilkar

and D.Y. Chandrachud was hearing a petition filed by the Internet and Mobile

Association of India (IAMAI) challenging the 6 April RBI circular that prohibited

banking services for dealing in virtual currencies, while giving three months to

banks to settle their accounts with such entities or customers.

The apex court issued a notice to the RBI while asking it to consider the

representations made by the stakeholders in the matter.

RBI has repeatedly through its public notices on December 24, 2013, February

1, 2017 and December 5, 2017, cautioned users, holders and traders of

virtual currencies, including Bitcoins, regarding various risks associated in

dealing with such virtual currencies.

Economic and Political News

GDP, retail inflation base years to be changed to 2017-18 and 2018

CCEA may hike MSP of paddy by Rs 200 a quintal, pulses by Rs 400

Indian aluminium exports jump 36% in 2017-18 on high global demand

Odisha to seek corporate CSR funding for 'Aahaar' scheme

Corporate News

NCLT to pronounce order on Tata-Mistry battle today

Fearing insolvency proceedings, promoters line up to pay their dues

Fearing insolvency proceedings, promoters line up to pay their dues

Jaiprakash Associates moves SC, seeks approval of revival plan for JIL

Vedanta weighs $7 billion merger with Anglo American South Africa

After Sebi orders it to make open offer for NDTV shares, VCPL to appeal

Market Outlook

July 04, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

6,189

636

867

36.3

the market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,997

624

720

16.9

presence in tier-II & III cities where the growth

opportunity is immense.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster resolution

ICICI Bank

1,77,189

272

416

52.9

of NPA would reduce provision cost, which would

help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,202

410

589

43.6

B2C sales and higher exports to boost the revenues

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

1,741

307

475

54.7

requirement and 15 year long radio broadcast

licensing.

Strong brands and distribution network would boost

Siyaram Silk Mills

2,423

522

851

63.1

growth going ahead. Stock currently trades at an

inexpensive valuation.

GST regime and the Gujarat plant are expected to

Maruti Suzuki

2,66,471

8,979

10,619

18.2

improve the company’s sales volume and margins,

respectively.

We expect loan book to grow at 24.3% over next

GIC Housing

1,888

347

655

88.8

two year; change in borrowing mix will help in NIM

improvement

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,378

622

720

16.1

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

Source: Company, Angel Research

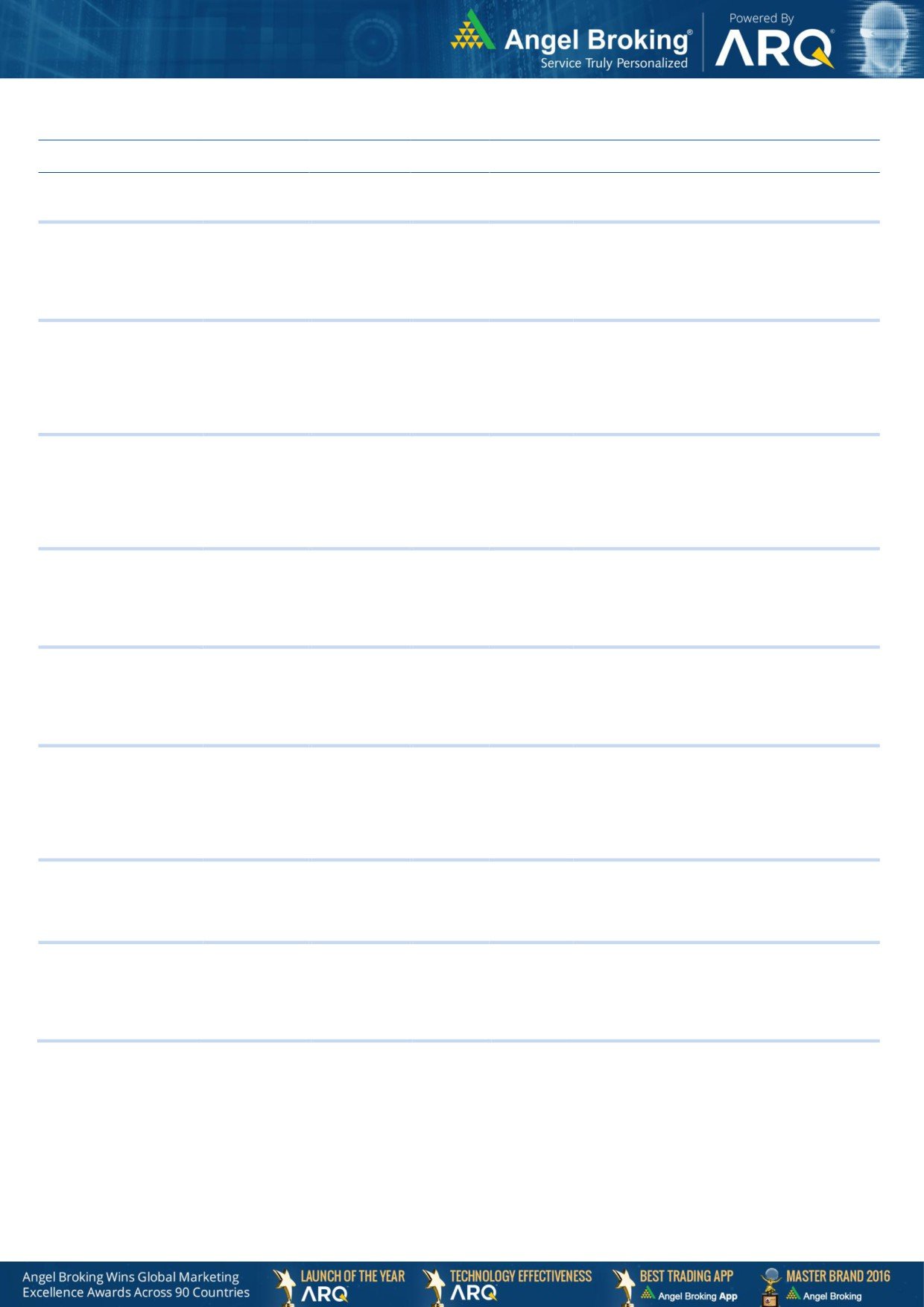

Market Outlook

July 04, 2018

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect financialisation of savings and

Aditya Birla Capital

29,320

130

218

63.7

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,636

310

410

30.8

Value Added Products and reduction in interest

cost is likely to boost margins and earnings in next

few years.

We expect MCL to report net revenue CAGR of

~15% to ~`450cr over FY2018-20E mainly due

to strong growth in online matchmaking &

Matrimony.com Ltd

1,637

779

1,016

30.4

marriage related services. On the bottom-line

front, we expect a CAGR of ~28% to `82cr over

the same period on the back margin

improvement.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other

HDFC Bank

5,48,970

2,073

2,315

9.8

income aided PAT growth. The Strong liability

franchise and healthy capitalisation provides

strong earning visibility. At the current market

price, the bank is trading at 3.2x FY20E ABV.

We expect strong PAT growth on back of healthy

growth in automobile segment (on back of new

launches and facelifts in some of the model ) and

M&M

1,12,788

892

1,050

17.1

strong growth in Tractors segment coupled by its

strong brand recall and improvement in rural

sentiment

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of 55.4%. It is a one-stop solutions

Amber Enterprises

2,793

1,015

1,230

21.1

provider for the major brands in the RAC industry

and currently serves eight out of the 10 top RAC

brands in India

BIL is the largest footwear retailer in India,

offering footwear, accessories and bags across

brands. We expect BIL to report net PAT CAGR of

Bata India

10,634

836

948

13.4

~16% to ~`3115cr over FY2018-20E mainly due

to new product launches, higher number of stores

addition and focus on women’s high growth

segment and margin improvement

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by rising

Shriram Transport Finance

29,532

1,298

1,764

37.5

bond yields on the back of stronger pricing power

and an enhancing ROE by 750bps over FY18-

20E, supported by decline in credit cost.

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

Jindal Steel & Power Limited

20,036

208

350

69.1

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

Source: Company, Angel Research

Market Outlook

July 04, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,594

267

360

34.8

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,379

1,619

2,178

34.5

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,653

2,034

2,500

22.9

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

2,861

228

395

71.3

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

GMM Pfaudler Limited (GMM) is the Indian market

leader in glass-lined (GL) steel equipment. GMM is

expected to cross CAGR 15%+ in revenue over the

GMM Pfaudler Ltd

1,166

800

1,020

27.5

next few years mainly led by uptick in demand from

user industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

L&T Fin’s new management is on track to achieve

L&T Finance Holding

30,266

147

210

42.5

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Amongst the Indian Pharmaceutical companies, we

believe that Aurobindo Pharmaceuticals is well

placed to face the challenging generic markets,

given its focus on achieving growth through

Aurobindo Pharmaceuticals

35,327

627

780

24.8

productivity. We expect Aurobindo to report net

revenue CAGR of ~13% & net profit to grow at

~5% CAGR during FY2018-20E, due to increased

R&D expenditure.

Market Outlook

July 04, 2018

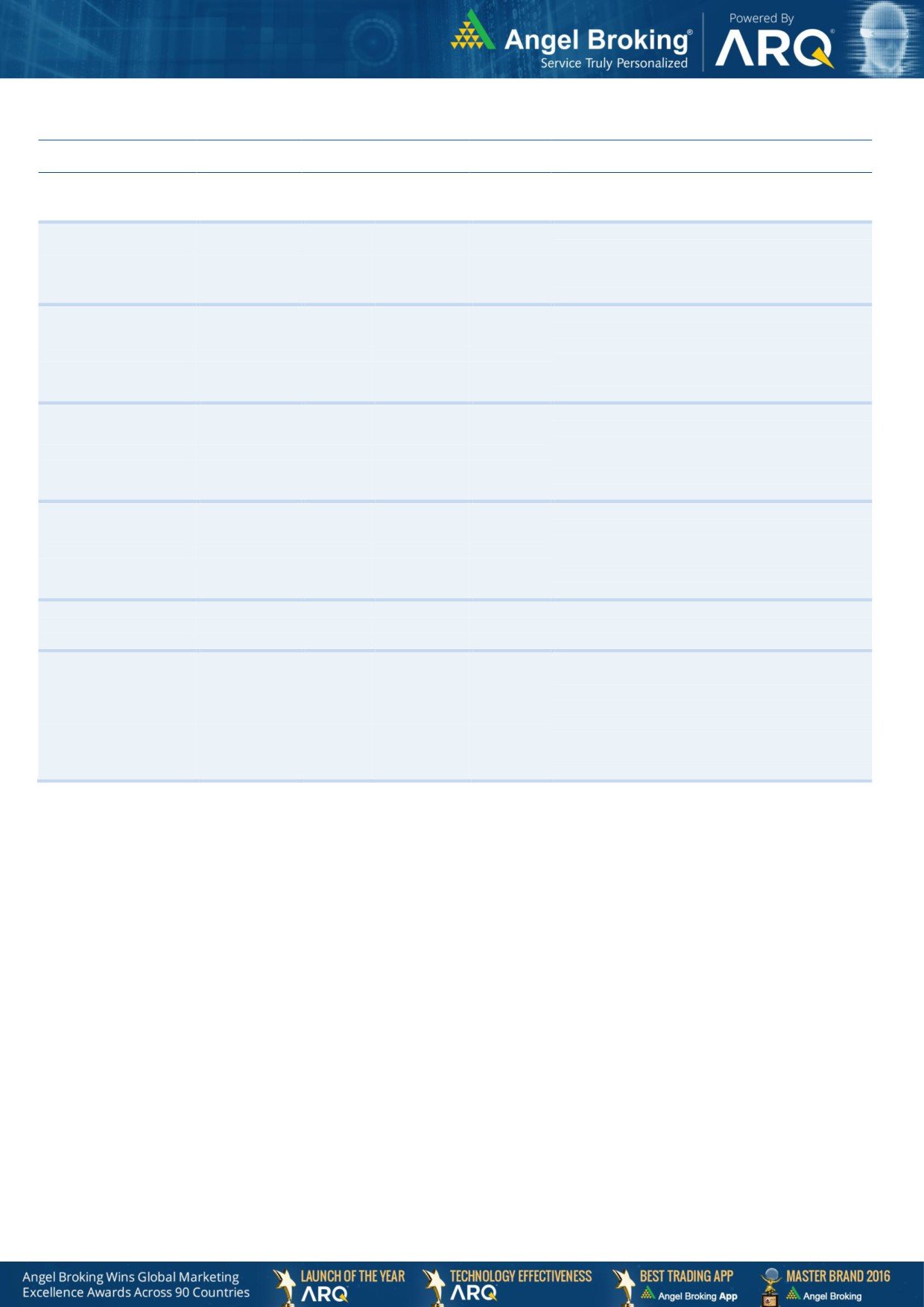

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time Country

Event Description

Unit

Period

Last Reported

Estimated

Jul 04, 2018

2:00 PMUK

PMI Manufacturing

Value

Jun

54.40

54.00

Jul 05, 2018

1:25 PMGermany

PMI Services

Value

Jun F

53.90

53.90

Jul 06, 2018

6:00 PMUS

Change in Nonfarm payrolls

Thousands

Jun

223.00

200.00

6:00 PMUS

Unnemployment rate

%

Jun

3.80

3.80

Jul 10, 2018

2:00 PMUK

Industrial Production (YoY)

% Change

May

1.80

7:00 AMChina

Consumer Price Index (YoY)

% Change

Jun

1.80

Jul 11, 2018

US

Producer Price Index (mom)

% Change

Jun

1.00

Jul 12, 2018

India

Imports YoY%

% Change

Jun

14.85

India

Exports YoY%

% Change

Jun

20.18

5:30 PMIndia

Industrial Production YoY

% Change

May

4.90

6:00 PMUS

Consumer price index (mom)

% Change

Jun

0.20

0.20

Jul 13, 2018

7:30 AMChina

Industrial Production (YoY)

% Change

Jun

6.80

Jul 16, 2018

China

Exports YoY%

% Change

Jun

12.60

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Jun

4.43

7:30 AMChina

Real GDP (YoY)

% Change

2Q

6.80

Jul 17, 2018

6:45 PMUS

Industrial Production

%

Jun

(0.09)

2:00 PMUK

Jobless claims change

% Change

Jun

(7.70)

Jul 18, 2018

6:00 PMUS

Housing Starts

Thousands

Jun

1,350.00

6:00 PMUS

Building permits

Thousands

Jun

1,301.00

2:30 PMEuro Zone

Euro-Zone CPI (YoY)

%

Jun F

2.00

2:00 PMUK

CPI (YoY)

% Change

Jun

2.40

Jul 23, 2018

7:30 PMUS

Existing home sales

Million

Jun

5.43

7:30 PMUS

New home sales

Thousands

Jun

689.00

Jul 25, 2018

5:15 PMEuro Zone

ECB announces interest rates

%

Jul 26

-

Source: Bloomberg, Angel Research

Market Outlook

July 04, 2018

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

8.5

10.0

9.0

9.1

7.3

7.5

8.0

7.0

9.0

8.0

8.1

7.6

7.6

7.7

7.0

8.0

7.2

7.0

6.0

6.8

4.8

4.6

4.9

7.0

6.3

5.0

4.1

6.1

5.6

4.0

6.0

3.0

1.8

5.0

2.0

1.0

4.0

1.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

4.9

52.0

5.0

4.4

4.6

4.3

50.0

4.0

3.6

3.3

3.3

48.0

3.0

2.4

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

35.0

6.50

30.0

6.00

25.0

5.50

20.0

5.00

15.0

4.50

10.0

4.00

5.0

3.50

0.0

(5.0)

3.00

Source: Bloomberg, Angel Research as on 3 July,2018

Source: RBI, Angel Research

Market Outlook

July 04, 2018

Global watch

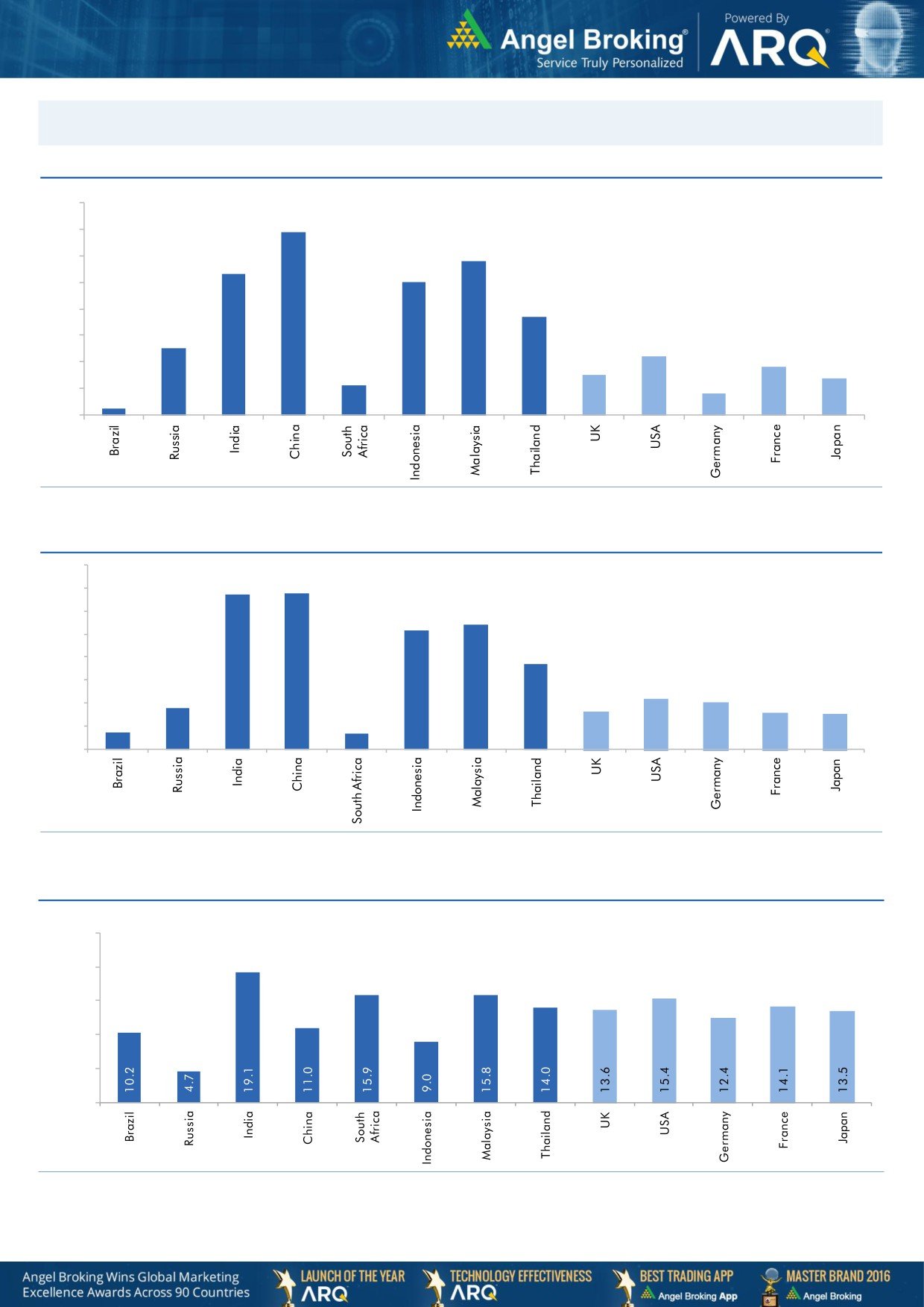

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

25.0

20.0

15.0

10.0

5.0

-

Source: IMF, Angel Research as on 3 July,2018

Market Outlook

July 04, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

72,840

(5.1)

(14.7)

17.1

Russia

Micex

4,503

1.4

7.1

11.4

India

Nifty

10,657

(0.7)

4.4

12.1

China

Shanghai Composite

2,776

(10.9)

(11.7)

(12.7)

South Africa

Top 40

50,980

2.4

5.9

12.2

Mexico

Mexbol

46,654

4.5

1.8

(6.4)

Indonesia

LQ45

902

(2.3)

(14.5)

(6.8)

Malaysia

KLCI

1,685

(2.0)

(9.4)

(5.8)

Thailand

SET 50

1,058

(6.8)

(10.9)

6.3

USA

Dow Jones

24,307

(0.4)

2.8

13.2

UK

FTSE

7,548

(1.7)

7.1

2.6

Japan

Nikkei

21,812

(1.8)

3.1

8.3

Germany

DAX

12,238

(2.9)

2.5

(1.9)

France

CAC

5,277

(2.3)

2.1

2.4

Source: Bloomberg, Angel Research as on 3 July,2018

Market Outlook

July 04, 2018

Exhibit 7: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

20-06-2018

Top Picks

Shriram Transport Finance Com

1,466

1,764

Open

01-07-2018

Top Picks

Bata India

862

948

Open

18-06-2018

Top Picks

Bata India

779

896

14-06-2018

Top Picks

Amber Enterprises

1,026

1,230

Open

07-06-2018

Top Picks

M&M

918

1050

Open

04-05-2018

Top Picks

M&M

860

990

03-05-2018

Fundamental

L&T Finance Holding

171

210

Open

02-05-2018

Top Picks

HDFC Bank

1944

2315

Open

04-05-2018

Top Picks

Matrimony.com Ltd

810

1016

Open

20-04-2018

Top Picks

Matrimony.com Ltd

781

984

15-05-2018

Top Picks

Parag Milk Foods Limited

310

410

Open

16-04-2018

Top Picks

Parag Milk Foods Limited

249

333

29-06-2018

Fundamental

GMM Pfaudler Limited

932

1,020

Open

14-05-2018

Fundamental

GMM Pfaudler Limited

818

900

06-04-2018

Fundamental

GMM Pfaudler Limited

712

861

07-03-2018

Fundamental

Ashok Leyland Ltd

139

163

Closed (26/04/2018)

03-03-2018

Fundamental

Greenply Industries

340

395

Open

16-04-2018

Top Picks

Safari Industries

651

750

Open

21-02-2018

Top Picks

Safari Industries

532

650

31-05-2018

Top Picks

HSIL Ltd

348

Closed (31/05/2018)

16-02-2018

Top Picks

HSIL Ltd

433

510

07-02-2018

Fundamental

Elantas Beck India Ltd.

2155

2500

Open

01-02-2018

Top Picks

ICICI Bank

352

416

Open

01-02-2018

Top Picks

Aditya Birla Capital

167

218

Open

04-01-2018

Fundamental

CCL Products

278

360

Open

03-01-2018

Fundamental

Nilkamal Ltd

1880

2178

Open

01-01-2018

Fundamental

Capital First Ltd

693

850

Closed (15/01/2018)

30-12-2017

Fundamental

Shreyans Industries Ltd

205

247

Closed

Fundamental

Prism Cement Ltd

160

Closed (09/05/2018)

21-12-2017

Fundamental

Prism Cement Ltd

118

131

18-12-2017

Fundamental

Menon Bearings Limited

92

114

Closed (17/01/2018)

14-12-2017

Top Picks

Ruchira Papers Ltd.

188

244

Closed (09/02/2018)

17-05-2018

Top Picks

Century Plyboards India

280

Closed(17/05/2018)

28-11-2017

Top Picks

Century Plyboards India

317

400

19-12-2017

Top Picks

LT Foods

85

Closed(18/06/2018)

06-11-2017

Top Picks

LT Foods

74

96

16-10-2017

Fundamental

Endurance Technologies Ltd

1111

1277

Closed (01/12/2017)

11-09-2017

Top Picks

GIC Housing

533

655

Open

10-10-2017

Top Picks

Music Broadcast Limited

404

475

Open

20-07-2017

Top Picks

Music Broadcast Limited

368

434

07-07-2017

Fundamental

L&T Finance Holdings Ltd

149

179

Closed (28/8/2017)

06-07-2017

Fundamental

Syngene International

478

564

Closed (1/3/2018)

05-07-2017

Top Picks

Maruti

7371

10619

Open

05-06-2017

Top Picks

Karur Vysya Bank

127

100

Closed (12/03/2018)

23-05-2018

Top Picks

KEI Industries

481

589

Open

Source: Company, Angel Research

Market Outlook

July 04, 2018

Exhibit 8: Historical Angel Top Picks/Fundamental Calls

Date Added

Top Picks/Fundamental

Stocks

Reco Price

Target/Revised Price

Current Status

04-01-2017

Top Picks

KEI Industries

125

485

31-05-2018

Top Picks

Alkem Lab

1978

Closed (31/05/2018)

01-12-2016

Top Picks

Alkem Lab

1700

2441

17-10-2016

Top Picks

Asian Granito

267

534

Closed (18/02/2018)

17-05-2018

Top Picks

TV Today Network

460

Closed (17/05/2018)

04-08-2016

Top Picks

TV Today Network

297

603

05-04-2016

Top Picks

DHFL

189

720

Open

25-06-2018

Top Picks

Navkar Corporation

207

Closed(25/06/2018)

05-01-2016

Top Picks

Navkar Corporation

207

265

Open

08-12-2015

Top Picks

Blue Star

357

867

Open

30-10-2015

Top Picks

Siyaram Silk Mills

186

851

Open

Source: Company

Market Outlook

July 04, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.